Chapter 3: Withdrawals

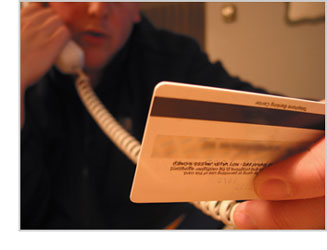

Like checks, debit cards allow you to pay your bills and make purchases in supermarkets, restaurants, and other stores. Many people find it more convenient to use their debit card than write a check, and, in fact, many stores today do not even accept checks. When you use your card, the cashier may ask, “Do you want to use debit or credit?” When you select the debit option, you are required to enter your pin number in a keypad. In some stores, such as supermarkets, you are also given the option of getting cash back. There is typically no fee charged for this service. When you select the credit option, you are required to sign the receipt, unless the purchase amount is very small. You are also given some protections that credit cards have. For example, if the item you purchased is defective, you can ask for a chargeback (a reversal of the charge to your account). Neither option is inherently better than the other, but because of the additional protection provided, you may want to choose the credit option for larger purchases. Keep in mind that regardless of whether you choose the credit or the debit option, a debit card does not work the same way as a credit card. When you use a credit card, you are borrowing money from the financial institution that issued that card, and you pay it back at a later date. If you want to buy a $100 pair of shoes with a credit card, it does not matter if you have $100 the moment you buy it. (However, just because you can, does not mean you should use your credit card when you cannot afford to pay off the balance in full.) When you use your debit card, the money is immediately deducted from your checking account. If you only have $50 in your account, either the transaction will be denied or, if approved, your account will become overdrawn and you may be charged a fee. Checks

It is easy to forget about a check once it leaves your hands. To prevent this from happening, take the time to note at least the following for every check you write:

Furthermore, once the check is deposited and no longer outstanding, you should mark that as well. Most checkbooks come with a register where you can record your check information. If not, a piece of paper or computer spreadsheet will do the trick. One very important difference between debit cards and checks is that when you write a check, the money is not deducted from your checking account immediately. The money is only deducted once the person you wrote the check to brings it to his or her financial institution and the check is sent to your financial institution. (However, there are special types of checks that are pre-paid, namely certified and cashier’s checks and money orders. These types of checks may be required when you make certain purchases.) Since the money is not deducted right away, is it okay to write a check for more than amount you have in your account if you expect to deposit more money in the next day or two? No. This is called “floating”, and it is an extremely dangerous practice to engage in. While in the past it commonly took several days for a check to be processed, checks today can be transmitted electronically and are processed much quicker. If the check is processed before you deposit additional funds, your check could bounce or your account could become overdrawn (discussed more in Chapter 4). Electronic checks In order to pay by electronic check, you must provide your routing number and account number. Sometimes a check number is also required. The diagram below shows where you can find this information on a check. Only submit electronic checks on secure sites (look for a web address starting with https or a lock icon), and remember to print out the payment confirmation page for your records.

Automatic debit Like with direct deposit, starting automatic debit can be done by filling out an enrollment form. (Most businesses provide them on their website or will send one upon request.) It is a good idea to check your account the day after the scheduled debit date to ensure that it actually took place. Mistakes sometimes happen, and if the debit for some reason did not occur, you are still responsible for paying the bill. If you decide after enrolling in automatic billing that you want to cancel it, you usually can do so as long as you give enough notice. Online bill payMany financial institutions offer the option of online bill pay. Instead of writing a paper check to pay a bill, you log into your checking account online and input the amount that you want to send to your service provider, lender, or whoever else you need to pay. Your financial institution will then either send an electronic check or print and mail a check for you. Using on-line bill pay through your financial institution offers convenience – you can pay your bills through one website instead of having to log onto the individual websites of every service provider and lender. To set up this service, you usually just need to provide your financial institution with the information that is on your bill, such as your account number and the company’s name and address. It is also a good idea to confirm with your lender or service provider that they accept online bill pay. |

|

| Copyright © 2010 CCCS OF SAN FRANCISCO | |

Debit cards

Debit cards